The Impact of Big Data Analytics on Business Intelligence and Decision-Making

In today’s digital age, businesses are inundated with vast amounts of data from various sources, including customer interactions, sales transactions, social media, and IoT devices. However, with proper tools and techniques to analyze and extract insights from this data, it is utilized. Big data analytics has emerged as a game-changer, enabling businesses to harness the power of data to drive informed decision-making and gain a competitive edge. In this blog post, we’ll explore the impact of big data analytics on business intelligence and decision-making, with a focus on the role of white label crypto exchange in supporting these endeavours.

Contents

Understanding Big Data Analytics:

Big data analytics refers to examining large and complex datasets to uncover patterns, trends, and correlations that can provide valuable insights and inform business decisions. It involves the use of advanced analytical techniques, such as machine learning, data mining, and predictive analytics, to extract actionable insights from structured and unstructured data sources.

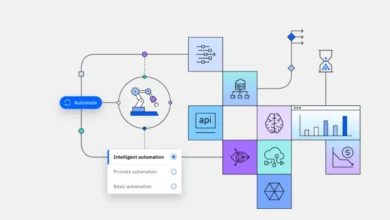

Transforming Business Intelligence:

Business intelligence (BI) encompasses the strategies, technologies, and practices organizations use to analyze data and gain insights into their operations, customers, and market trends. Big data analytics revolutionizes BI by enabling businesses to process and analyze massive volumes of data in real time, uncovering hidden patterns and trends that traditional BI tools may overlook.

Critical Components of Big Data Analytics:

Big data analytics comprises several key components, including:

Data Collection: Big data analytics begins with collecting data from diverse sources, including internal databases, external sources, social media platforms, and IoT devices. This data may be structured, semi-structured, or unstructured, requiring specialized tools and techniques for processing and analysis.

Data Storage:

Big data analytics relies on scalable and distributed storage systems, such as data lakes and cloud-based databases, to store large volumes of data efficiently. These storage systems provide the flexibility and agility to handle diverse data types and support real-time analytics.

Data Processing:

Big data analytics platforms employ distributed computing frameworks like Hadoop and Spark to process and analyze large datasets in parallel. These frameworks enable rapid data processing and facilitate complex analytical tasks, such as machine learning and natural language processing.

Data Visualization:

Big data analytics tools often include data visualization capabilities, allowing users to create interactive dashboards, charts, and graphs to visualize and explore data insights. Visualization techniques help users understand complex data patterns and communicate insights effectively to stakeholders.

Impact on Decision-Making:

Big data analytics profoundly impacts business decision-making across various domains, including marketing, operations, finance, and customer service. Here are some ways in which big data analytics influences decision-making:

Predictive Analytics:

Big data analytics enables organizations to leverage predictive models to forecast future trends, identify potential risks and opportunities, and make proactive decisions to mitigate risks and capitalize on opportunities.

Customer Segmentation:

Big data analytics helps businesses segment their customer base based on demographic, behavioural, and psychographic attributes, allowing targeted marketing campaigns, personalized product recommendations, and improved customer experiences.

Operational Efficiency:

Big data analytics identifies inefficiencies and bottlenecks in business operations, enabling organizations to optimize processes, streamline workflows, and reduce costs through data-driven decision-making.

Risk Management:

Big data analytics provides insights into market dynamics, competitor behaviour, and regulatory changes, enabling organizations to assess and mitigate risks effectively and make informed decisions to safeguard their business interests.

The Role of White Label Crypto Exchanges:

White-label crypto exchanges can support the integration of big data analytics into business intelligence and decision-making processes by providing secure, transparent, and decentralized platforms for managing data assets and transactions. Here’s how:

Secure Data Management:

White-label crypto exchanges leverage blockchain technology to ensure secure and transparent data management. They facilitate the storage, sharing, and exchange of data assets among stakeholders by providing a decentralized platform for data storage and access, enhancing data security, integrity, and privacy.

Tokenized Incentives:

White-label crypto exchanges can tokenize incentives and rewards for stakeholders who contribute data to significant data analytics initiatives or participate in data-driven decision-making processes. By incentivizing data sharing and collaboration, these exchanges foster a culture of data-driven innovation and empower stakeholders to derive value from their data assets.

Decentralized Governance:

Blockchain-based governance mechanisms, supported by white-label crypto exchanges, enable decentralized decision-making and accountability in significant data analytics initiatives. By establishing transparent voting mechanisms, consensus algorithms, and governance frameworks, these exchanges empower stakeholders to shape the direction of data analytics projects and ensure alignment with organizational goals and values.

Conclusion:

Big data analytics is a transformative force that empowers organizations to unlock the value of data and gain actionable insights to drive business growth and innovation. By harnessing the power of big data analytics and supporting it with white-label crypto exchanges, businesses can make informed decisions, optimize operations, and stay ahead of the competition in today’s data-driven economy.